Your legacy is more than just what you leave behind—it’s the story of your life, the values you cherish, and the financial foundation you’ve built for your loved ones. But here’s the twist: without the right planning, your legacy could get tangled in the web of probate, lost in legal fees, or even distributed in ways you never intended.

Enter the trust—the ultimate power move in estate planning. A trust isn’t just a tool; it’s a legacy amplifier. It’s how the wealthy stay wealthy, how families avoid drama, and how you can ensure your life’s work is passed on exactly as you envision.

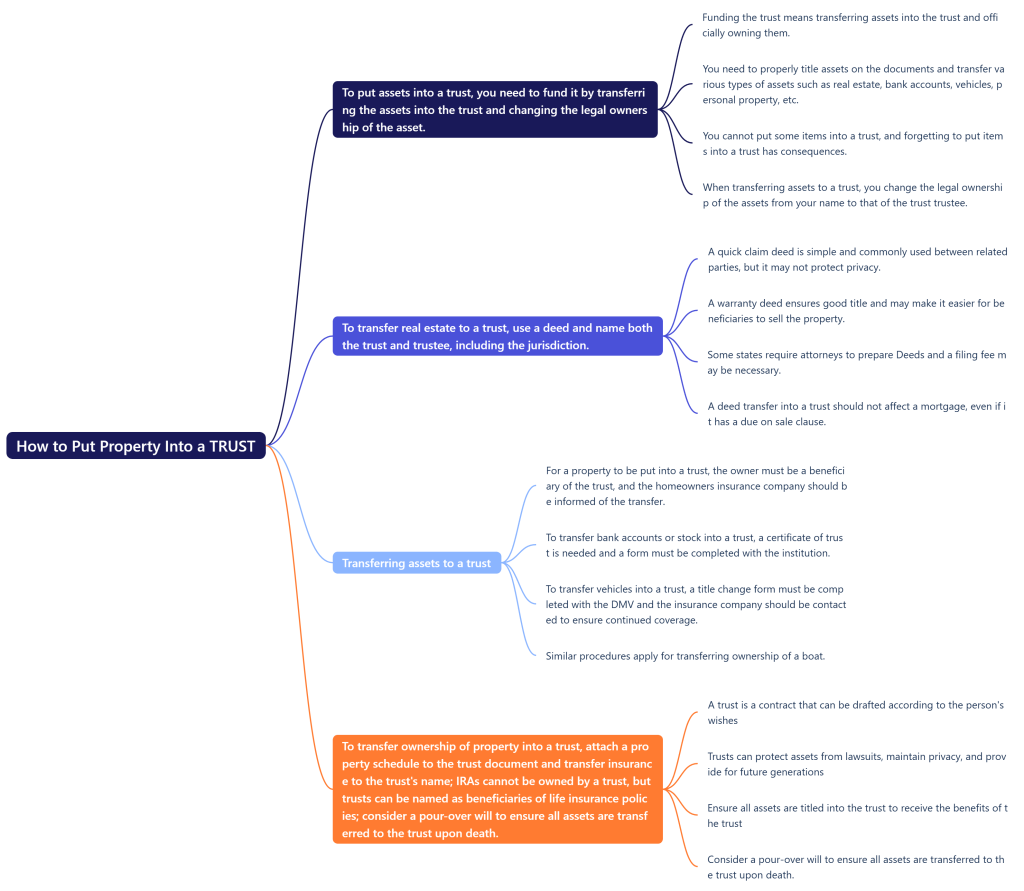

But here’s the kicker: creating a trust is only half the battle. To unleash its full power, you need to fund it—aka, transfer your property into the trust. If you don’t, your trust is like a treasure chest with no treasure inside.

Let’s dive deep into the art and science of putting property into a trust—BrainyVerse style.

What’s the Big Deal About a Trust?

Imagine this: You’ve worked your whole life to build wealth, buy a home, and secure your family’s future. Now imagine all of that being tied up in probate court for months—or even years—while your loved ones wait and watch the fees pile up.

A trust solves that. It’s your shield against the chaos of probate, your tool to control how and when your assets are distributed, and your secret weapon for keeping your financial affairs private.

Here’s the genius part: a trust isn’t just for the ultra-rich. It’s for anyone who wants to protect their assets, avoid unnecessary taxes, and provide for their loved ones without the headaches of probate.

But remember: a trust is only as good as the assets inside it. That’s why funding your trust is the golden key to unlocking its full potential.

The Trust-Funding Playbook: Step-by-Step Genius Moves

So, how do you actually put property into a trust? Here’s the BrainyVerse blueprint:

Step 1: Assemble Your Dream Team

Every genius has a team. For you, that means an estate planning attorney or financial advisor. Sure, you could go the DIY route, but when it comes to your legacy, why risk it? A pro will make sure every “i” is dotted and every “t” is crossed.

Step 2: Take Inventory of Your Empire

List out everything you own—your home, bank accounts, investments, vehicles, and even that rare coin collection you’ve been hoarding. This is your empire, and it’s all about to go into the trust.

Pro Tip: Some assets, like retirement accounts and life insurance policies, can’t go directly into a trust. But don’t worry—you can name the trust as a beneficiary. More on that later.

Step 3: Retitle Your Assets Like a Boss

Here’s where the magic happens. To fund your trust, you need to retitle your assets so the trust becomes the legal owner. Think of it as transferring your empire to a new ruler—you, but in trust form.

- Real Estate:

File a new deed with your county recorder’s office, listing the trust as the owner. This step is critical—don’t skip it! - Bank Accounts:

Visit your bank and update the ownership of your accounts. Bring a copy of your trust document because they’ll definitely ask for it. - Investment Accounts:

Contact your brokerage and retitle your accounts in the name of the trust. This ensures your investments flow seamlessly into the trust. - Vehicles:

Head to the DMV (yes, we know, ugh) and transfer the title of your car, boat, or any other vehicle to the trust. - Personal Property:

For high-value items like jewelry, art, or collectibles, you can simply list them on a trust schedule—a document that itemizes what the trust owns.

Step 4: Update Beneficiary Designations

For assets like retirement accounts, life insurance policies, and annuities, you can’t transfer ownership directly to the trust. Instead, name the trust as the beneficiary. This ensures these assets flow into the trust when you pass away.

Step 5: Keep Receipts (Literally)

Once you’ve retitled your assets, keep copies of all updated deeds, account statements, and titles. This paperwork is your proof that the trust is funded and ready to roll.

What Happens If You Don’t Fund Your Trust?

Here’s the harsh truth: an unfunded trust is like a sports car with no engine. It looks great on paper, but it won’t take you anywhere.

If you don’t transfer your property into the trust, your assets will still go through probate, and the trust won’t provide the benefits you intended. That’s why many estate plans include a pour-over will—a backup plan that transfers any unfunded assets into the trust after your death.

But let’s be real: why leave it to chance? Fund your trust now and save your loved ones the hassle later.

Avoid These Trust-Funding Pitfalls

Even the best-laid plans can go awry if you’re not careful. Here are the top mistakes to avoid:

- Procrastination: Waiting too long to fund your trust leaves your assets vulnerable.

- Forgetting to Update Titles: If the trust isn’t listed as the owner, it’s not part of the trust. Period.

- Ignoring Beneficiary Designations: Don’t forget to align your beneficiary designations with your trust.

- DIY Disasters: Estate planning is complicated. Don’t be a hero—get professional help.

The BrainyVerse Perspective: Legacy Is Power

At its core, putting property into a trust isn’t just about avoiding probate or saving on taxes—it’s about taking control. It’s about making sure your legacy is protected, your loved ones are cared for, and your wishes are honored.

When you fund your trust, you’re making a statement: “I’m in charge of my future, and I won’t leave it to chance.”

So don’t wait. Take inventory of your assets, retitle them like a pro, and ensure your trust is ready to do its job. Your future self—and your family—will thank you.

Final Thought: Your Legacy, Your Rules

Your legacy is your story, and a trust is the pen you use to write it. By funding your trust, you’re not just protecting your assets—you’re creating a roadmap for your family’s future.

Be the genius of your own story. Start funding your trust today, and watch your legacy shine brighter than ever.

BrainyVerse Wisdom: “A legacy isn’t just what you leave behind—it’s the impact you create while you’re here. Fund your trust, secure your future, and live your best life knowing your story will be told exactly as you intended.”